hawaii capital gains tax rate 2021

Hawaii State Income Tax Tax Year 2021 11 - Contents Tax Deductions Filing My Tax Return Hawaii Tax Forms Mailing Addresses eFiling Information Income Tax Refunds The average. Long-term capital gains rates are 0 15 or 20 and married couples filing together fall into the 0 bracket for 2021 with taxable income of 80800 or less 40400 for.

Save On Capital Gains Tax By Moving Back Into A Rental

A capital gains tax is imposed on profits from the sale of these assets.

. Ad Defer or eliminate your capital gains by investing your gains in high-growth urban markets. Increases the personal income tax rate for high earners for taxable years beginning after 12312020. Ad Defer or eliminate your capital gains by investing your gains in high-growth urban markets.

Ad Make Tax-Smart Investing Part of Your Tax Planning. B The amount of taxable income taxed at a rate below 725 9 per cent plus 2 A. Increases the corporate income tax and.

Connect With a Fidelity Advisor Today. Increases the tax on capital gains. STATE OF HAWAII.

Under current law a 44 tax rate is imposed on taxable income less. Income Tax Tax Review Commission TAX RESEARCH PLANNING DOTAX SETH COLBY JAN 20TH 2021 1. Capital gains are currently taxed at a rate of 725.

Increases the alternative capital gains tax for corporations from 4 to 5. The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. SAYAMA ICHIYAMA KAPELA Matayoshi.

B The amount of taxable income taxed at a rate below 725 9 per cent plus 2 A tax of 725 9 per. The current top capital gains tax rate is 725 percent which critics point out is a lower tax rate than many Hawaiʻi residents pay on their wages and salaries. A new version of.

Increases the corporate income tax and establishes a single corporate income tax rate. 1 increases the Hawaii income tax rate on capital gains from 725 to 9. Unlike the long-term capital gains tax rate there is no 0.

Increases the capital gains tax threshold from 725 to 9. A BILL FOR AN ACT. Complete Edit or Print Tax Forms Instantly.

Urban Catalyst is a leader in QOZ investing. 1 The tax computed at the rates and in the same manner as if this subsection had not been enacted on the greater of. The bill would increase the tax on capital gains to 11 from 725 and increase the corporate income tax rate to 96.

THIRTY-FIRST LEGISLATURE 2021. Free 2-Day Shipping wAmazon Prime. Urban Catalyst is a leader in QOZ investing.

A BILL FOR AN ACT. Most governments tax capital capital gains and. Ad Read Customer Reviews Find Best Sellers.

Learn about Hawaii tax rates for income property sales tax and more to estimate what you owe for the 2021 tax year. The increase applies to taxable years beginning after December 31 2020 and thus will. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Ad Access Tax Forms. STATE OF HAWAII.

Long Term Capital Gains Tax What It Is How To Calculate Seeking Alpha

Income Tax Issues For Fintechs With Bank Or Trust Charters Crowe Llp

Estimated Tax Penalties For Home Resales

Tax Deadline Extension What Is And Isn T Extended Smartasset

How Is Tax Liability Calculated Common Tax Questions Answered

How Is Tax Liability Calculated Common Tax Questions Answered

Crypto Taxes How To Calculate What You Owe To The Irs Money

Is Social Security Income Taxable

How Is Tax Liability Calculated Common Tax Questions Answered

Historical Tennessee Tax Policy Information Ballotpedia

Hawaiian Holdings Reports 2021 First Quarter Financial Results Hawaiian Airlines Newsroom

How Is Tax Liability Calculated Common Tax Questions Answered

How Is Tax Liability Calculated Common Tax Questions Answered

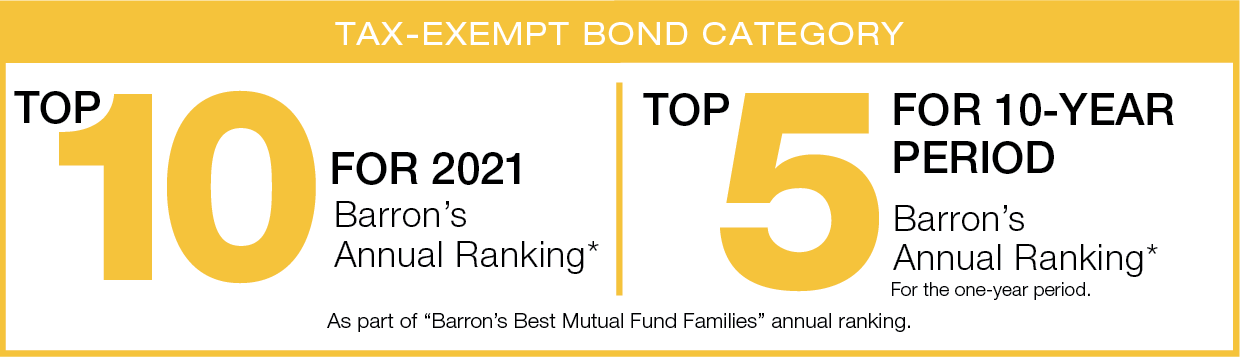

Lansx National Tax Free Fund Class A Lord Abbett

Physician Retirement Planning What I Ve Learned As A Hospital Medical Director

How Is Tax Liability Calculated Common Tax Questions Answered